You can control the cost of your organization’s workers’ compensation insurance by knowing a few insider tips used by workers’ compensation cost control consultants. What follows are three proven methods to reduce the cost of this vital insurance to the absolute minimum.

EXPERIENCE MODIFICATION

Most contractors accept their experience modification as an absolute number, with little ability to improve. That’s a mistake that can cost large sums of money and put concrete and general contractors at a competitive disadvantage when bidding for work.

Here is how you can improve your ex-mod. Begin by obtaining a copy of your Experience Rating Worksheet. This document contains the payrolls, claims, and other factors that make up the ex-mod. You should have received a copy of the worksheet in the mail, but if you didn’t, it is available from your insurance agent or broker, direct from your insurer, or by ordering a copy from the NCCI in Boca Raton, Florida.

With that worksheet and an up-to-date loss run in hand, check the following: Make certain the claims that have been charged to the ex-mod under the column labeled “Act Inc Losses” belong to your firm. We have seen firms charged for claims that belong to someone else, so it is a good idea to confirm that your ex-mod only contains your company’s claims.

Be aware of your loss valuation date and make certain that every claim possible is closed before that date. Generally, that date is 6 months before the ex-mod becomes effective. Otherwise, your ex-mod might include an open claim reserve that was settled. Remember, you can request the insurer’s claims adjuster to close claims before the loss valuation date.

Confirm that the insurer has correctly determined “Loss Adjustment Expenses” and omitted them from Incurred Losses. These are the insurer’s expenses and should not be charged to your ex-mod. Finally, check the payrolls in the column labeled “Payroll” and confirm that correct amounts are used. Also look for payroll for uninsured subcontractors charged on the premium audits. Payroll charged to these uninsured subs should be included in the ex-mod. This will lower your modifier.

PREMIUM ADJUSTMENT PROGRAM

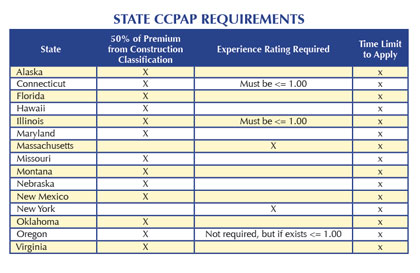

This is a potentially large credit available to contractors. It is available in 15 states: Alaska, Connecticut, Florida, Hawaii, Illinois, Maryland, Massachusetts, Missouri, Montana, Nebraska, New York, New Mexico, Oklahoma, Oregon, and Virginia. All 15 states require the policy to contain at least one construction-related classification and may have other requirements. Three states require that the experience modifier be no greater than 1.0. What follows is a general discussion of this credit, how it is administered, and how to apply for the credit.

Known by the acronym CCPAP, this is an often overlooked credit that is available to contractors that pay wages greater than their state’s average wage. Since workers’ compensation premium is, at its simplest, a rate times payroll, the higher the payroll, the higher the premium. The CCPAP lowers the premium resulting from above average pay.

Unfortunately, in-depth details of the credit are not widely known, among contractors and even among insurance professionals. Depending on the state, the credit begins with an average hourly wage of about $20 to $25.

If you have payroll in one of the 15 participating states then your policy should include NCCI Form NC-5000A. That form asks for gross payroll for the third calendar quarter of the year that precedes the policy’s effective date. NC-5000A has three columns: In the first you provide a class code or description of the work (electrical, supervisors, clerical, etc.), in the next you provide gross wages (after adjustments) for each classification of work, and in the third column you provide the corresponding number of hours worked. In most states, if you are a new business with no payroll in the previous year’s third quarter, you will use payroll and hours worked from the first complete quarter after the policy’s effective date.

Next, mail the completed form to either the state workers’ compensation rating bureau or the NCCI. They will calculate the credit and forward it to your insurer. The insurer will endorse your policy with the credit and carry it over to the final audit. In most states, the credit ranges from 5 to 25 percent of premium, depending on company-wide average wage. If you have operations in more than one state that has adopted the CCPAP, you will complete a separate application for each state. When the policy is audited after it expires, the insurer has the right to verify the payroll and hours shown on NC-5000A.

This credit is a useful tool for high-wage concrete and general contractors to save a large portion of their premium. It is also a great way gain an advantage over the competition. It is available for a reason, and you should take advantage of it.

GET THE MOST FROM CLASSIFICATIONS

Contractors may allocate the payrolls of construction employees to different classifications of work, provided that the contractor keeps contemporaneous records that support the payroll allocation. You should preemptively discuss how to set up the payroll records with the insurer’s audit department so that wages are allocated to all the classifications to which you are entitled. You should have available the online SCOPES Manual from the NCCI. It is a valuable tool that describes all classifications available and when they may, and may not, be used.

Sometimes the classification with the lowest rate does not result in the lowest premium. Because classifications are a component of the experience modifier and the CCPAP, seeking the lowest class rate might be more than offset by a higher ex-mod and a lower CCPAP and generate a higher premium. Care should be taken and a knowledgeable expert consulted when determining the best available workers’ compensation classifications.

Another premium saving suggestion: prepare a pre-audit before the annual audit. When the insurer completes their annual premium audit, they work from the records that you provide. Help make the auditor’s job more accurate by completing your own audit. Make certain that the prepared payrolls take into account all the credits, limitations, and deductions available. Many auditors will accept your prepared work product as their own.

Finally, when the audit is complete, request a copy of the auditor’s worksheets, review the worksheets with the auditor, and discuss how employees were classified. Then, when the final invoice arrives, be sure to compare it to those worksheets. ■

About the Author: Since 1979, Norman Goodman has helped the construction industry to lower the cost of workers’ compensation insurance with a variety of proven methods. He is based in Nashua, New Hampshire, and can be reached at zapcomp@gmail.com.

_________________________________________________________________________

Modern Contractor Solutions – May 2016

Did you enjoy this article?

Subscribe to the FREE Digital Edition of Modern Contractor Solutions magazine.

Cut the Cost of Your Workers’ Compensation Insurance